How To Create A Banking App

A Comprehensive Guide on How to Make a Banking App in 2021

Customers have associated banking with long queues and long searches for service terminals or ATMs until recently. With the advancement of the internet and technologies, there's no need to spend extra time on those tasks anymore. According to Allied Market Research, the global mobile banking market was valued at $715 million in 2018 and is expected to exceed $1,824 million by 2026. It clearly shows that the banking industry is among those areas that benefit the most from digitalization.

Reading these lines, you're probably thinking about building a mobile banking experience for users. However, you must be armed with the knowledge to make this work. So we've prepared a guide to help you create a banking app that'll meet your business goals and customers' needs.

Benefits of Mobile Banking for Business

Banks that go mobile gain a competitive edge. They build banking apps to:

- Level up service quality

- Increase client base

We'll consider the most significant benefits that banks will get by becoming mobile-friendly.

Wider Client Base

By providing users with an additional way to interact with the bank, you expand your customer base and offer new services. In fact, users appreciate the ability to use banking services online. There are over 57 million mobile banking users in the US and more than 130 million in Europe.

New Marketing Channel

Advertising is important for any business. The more distribution channels you have, the better. By developing a mobile banking application, you gain an additional way to advertise your services.

You can notify users about new app features, credit services, rates, and their changes using push notifications. This way, you'll always be in touch with customers and your advertising will be less intrusive than direct sales in a bank branch.

Good Return on Investment Ratio

It takes considerable investments to develop a mobile banking app. The return on investment is quite high though. While other banks without well-developed online services spend a lot of money maintaining bank branches and large staff, while companies that build banking apps for their business can gradually go digital, thereby reducing costs.

Revolut is an excellent example of this approach. Revolut is a British bank whose main concept is to operate entirely online without physical branches.

Irreplaceable Source of Information

When you create a banking app, you get tons of valuable customer information that gives you hints to growing a business. You can guide users on every step they make whether it's online purchases, utility payments, or quick loans to analyze users' behavior within the app. This analysis is crucial to build users' behavior models and come up with ideas for further app development. Besides that, there are a few more advantages:

- It'll be easier to provide a personalized experience.

- Ease of identifying app weaknesses.

- Better understanding of the target audience's needs and the problems to solve.

Preparations You Should Do Before the Development

Before you hire programmers and they start writing the code, you should get your idea through multiple preparations. As the product owner, you should conduct in-depth market research to shape your idea and form strict goals and requirements that can be easily delivered to the development team.

Market Research

For a smooth market entry, you must know it inside and out. The market research concerns the prospects of the market, pitfalls that may arise, current and future trends.

The mobile banking market is huge and has a vast user base. According to Juniper's study, the number of banking app users exceeded 1.75 billion worldwide. That is 32% of the total adult population.

To satisfy user needs, companies compete with each other, coming up with new features that make banking services easier for customers.

Analysts point out that the following innovations can become the main trends in mobile banking for 2021:

Voice control

This innovation is already in usage by market leaders such as ING Direct Canada, USAA, and many others. Voice commands should improve the user experience by letting quick access to features.

AI for fraud prevention

The security of personal data and financial transactions is the primary concern for banks that create banking apps. In this aspect, AI is the ultimate solution, thanks to automation and high efficiency. This technology can simultaneously monitor payments, cheques, and logins to detect and investigate any deviations from the usual activity of thousands of users.

Fully mobile banking

As we've mentioned earlier, this concept implies the digitalization of all services and no physical branches. Many people simply have no time for going to the bank to sign papers or arrange loans. Still, banks spend a pretty penny to maintain numerous branches.

In this case, both parties benefit from digitalization. Customers get fast and convenient service, while banks save a lot of money crossing out the branch-related expenses.

Target Audience Analysis

The better you know your target audience, the easier it'll be to set requirements for the banking app.

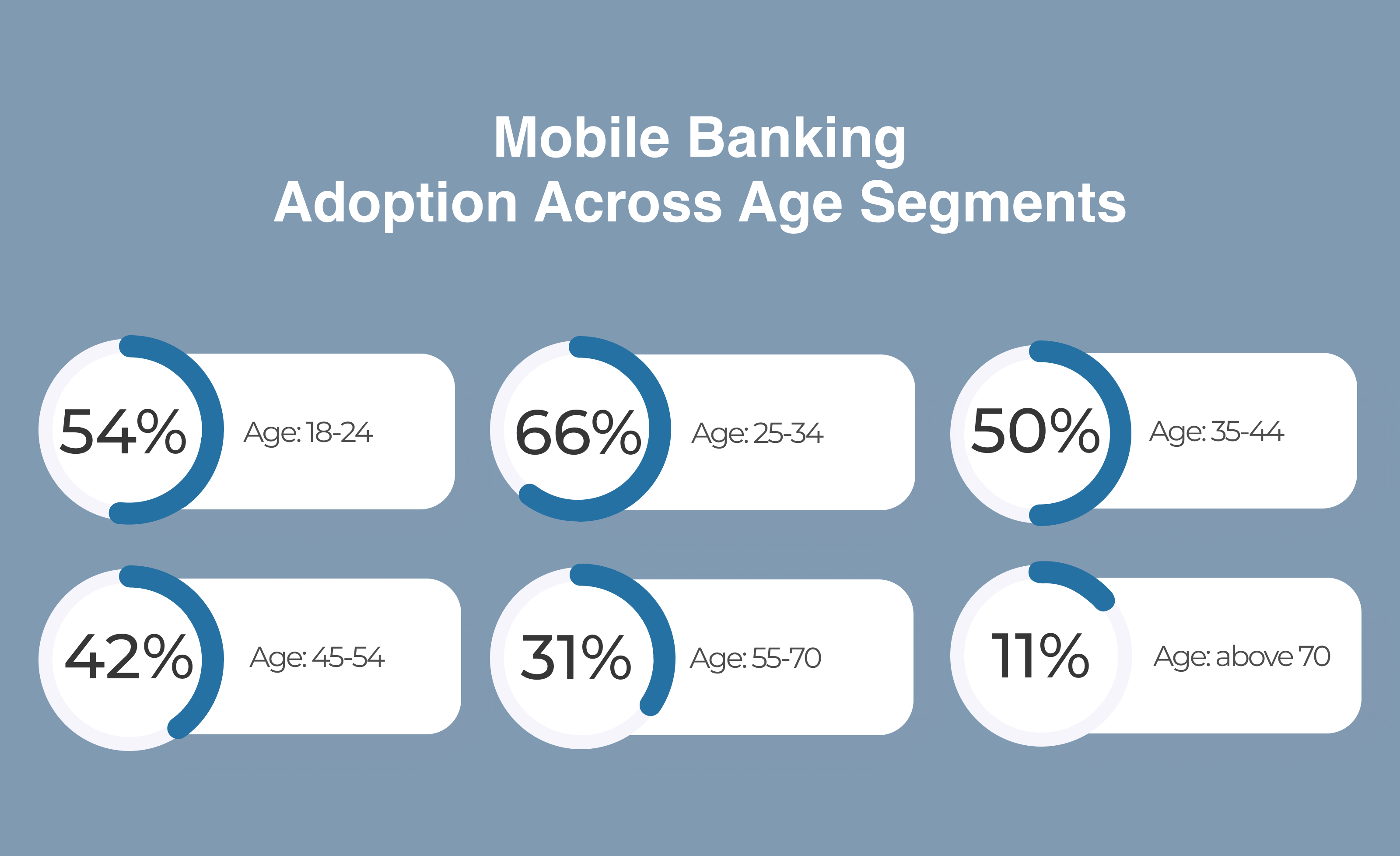

The audience of mobile banking is very broad in terms of age and has coverage from 18 to 70 years old and above. However, their user behavior differs. The audience from 18 to 24 mostly uses mobile banking for transfers of small amounts, purchases, school or university fees, and so on. Meanwhile, a mature audience from 25 to 70 uses mobile banking for utility bills, transactions of medium and large amounts of money, cash flow control, and so on.

Mobile banking age segmentation.

Competitor Research

Competitor analysis will help you find out with whom you'll be competing for customer attention. It can bring you valuable information about the competitors' services, how they deliver them. As a result, you'll get some ideas that'll help you stand out from the rivals.

We've selected some of the most popular apps in the mobile banking market to help you with this analysis.

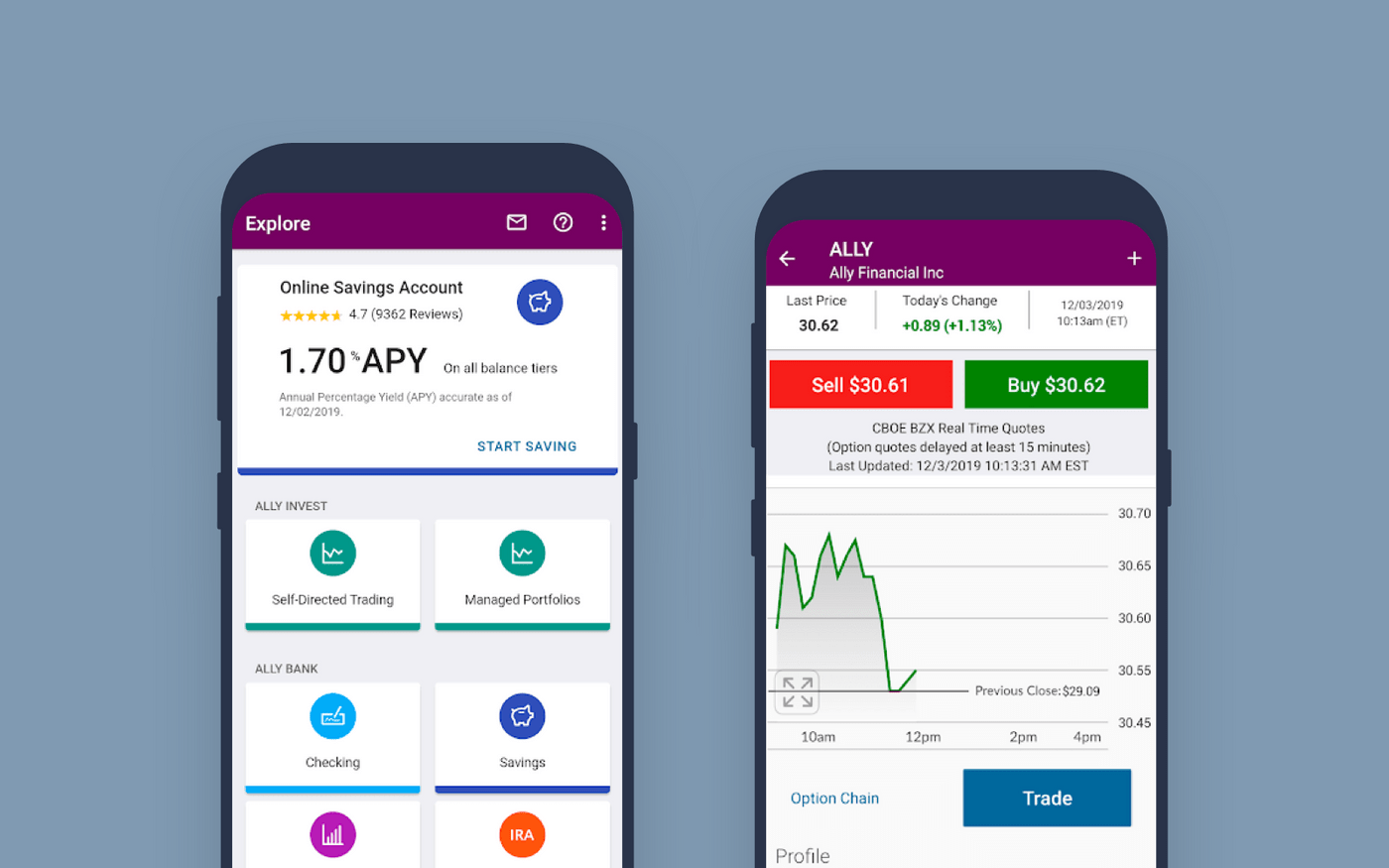

Ally Bank

Ally Bank is a mobile banking app available on iOS and Android. It covers basic features like deposit check, money transfers, bills payment, and ATM locator. Besides, Ally Bank has a trade stocks feature and lets users track their investment performance.

Ally Bank app interface.

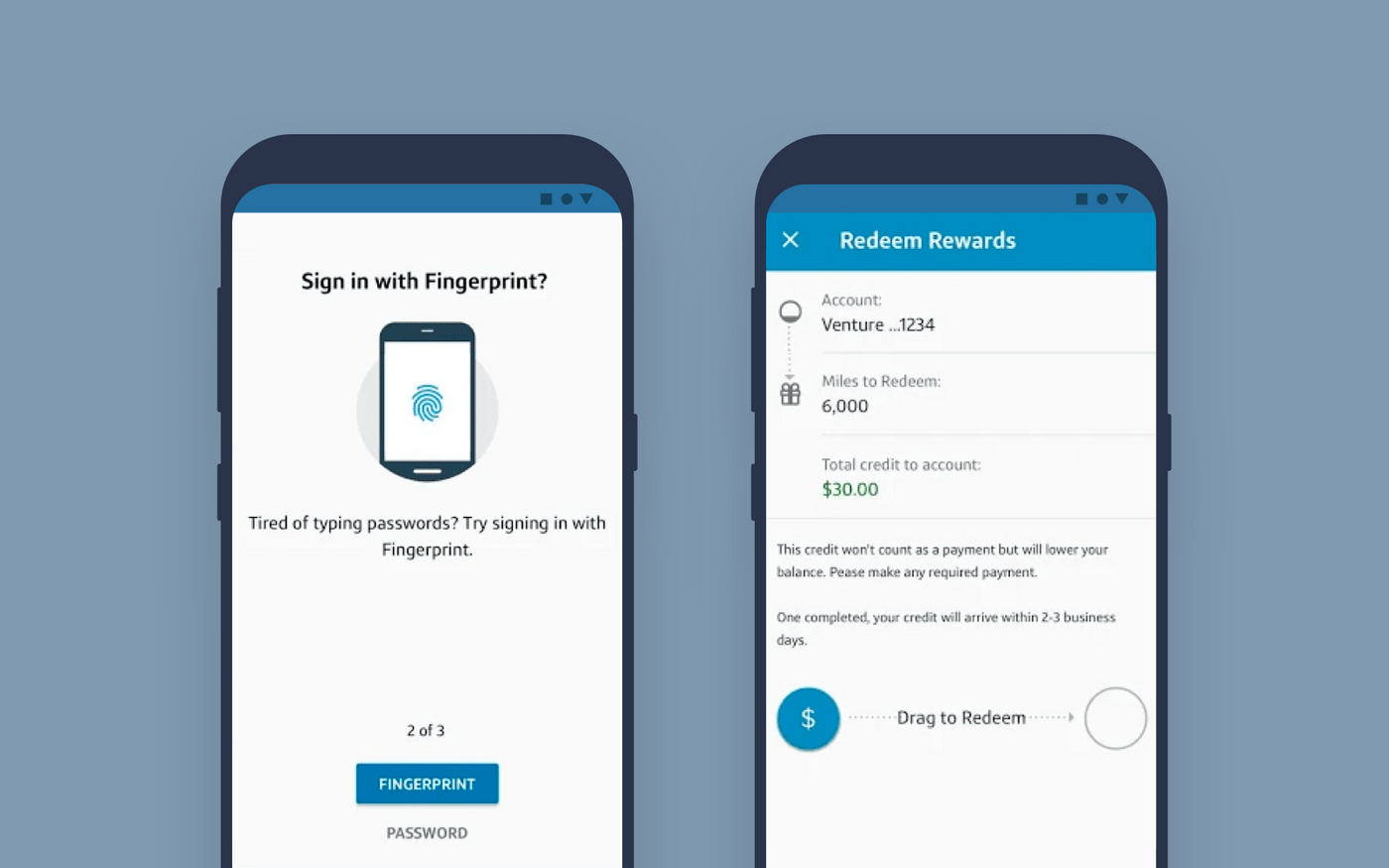

Capital One

This app is quite popular and has a user rating of 4.7 in the App Store and Google Play Store. Besides standard features, users note the convenient fingerprint login and credit history tracking via push notifications. Also, the app is at the forefront of the user's security and lets users block the card in case of its loss.

Capital One mobile app interface.

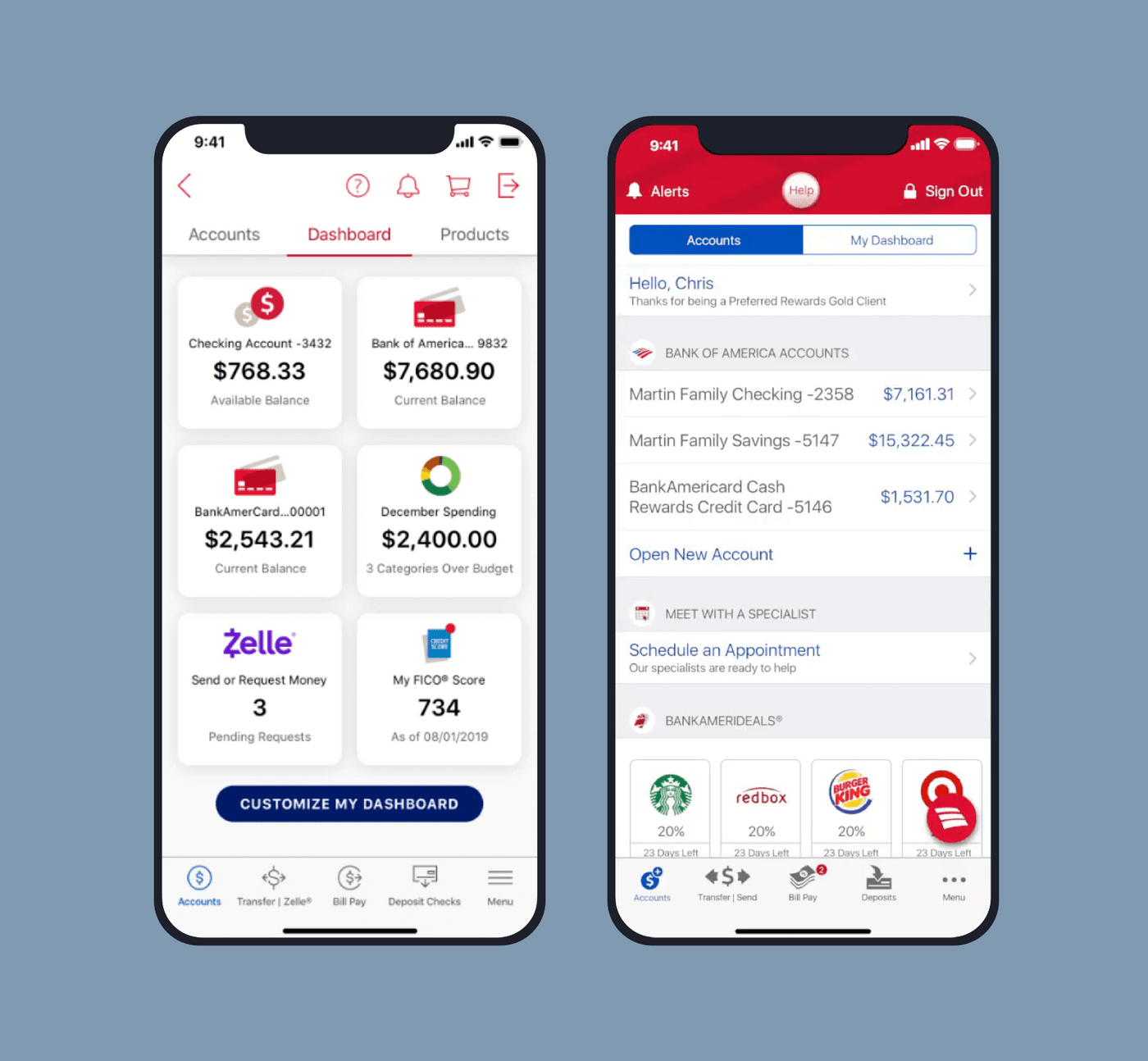

Bank of America

It's no surprise that one of America's most popular banks has a mobile banking app. This app brings a great user experience and security level. The Bank of America app offers a convenient feature of ordering and activating the card without visiting physical branches. Besides that, the app provides a high level of security by contacting the cardholder directly in case of suspicious activity.

Bank of America mobile app interface.

After the research is accomplished, it's time to draw up a list of features for the future banking app. These features can be divided into two categories: key features and additional features.

Key Features for a Mobile Banking App

These are the must-have features to create a banking app. We'll cover each feature in detail so you'll have a full picture for future research.

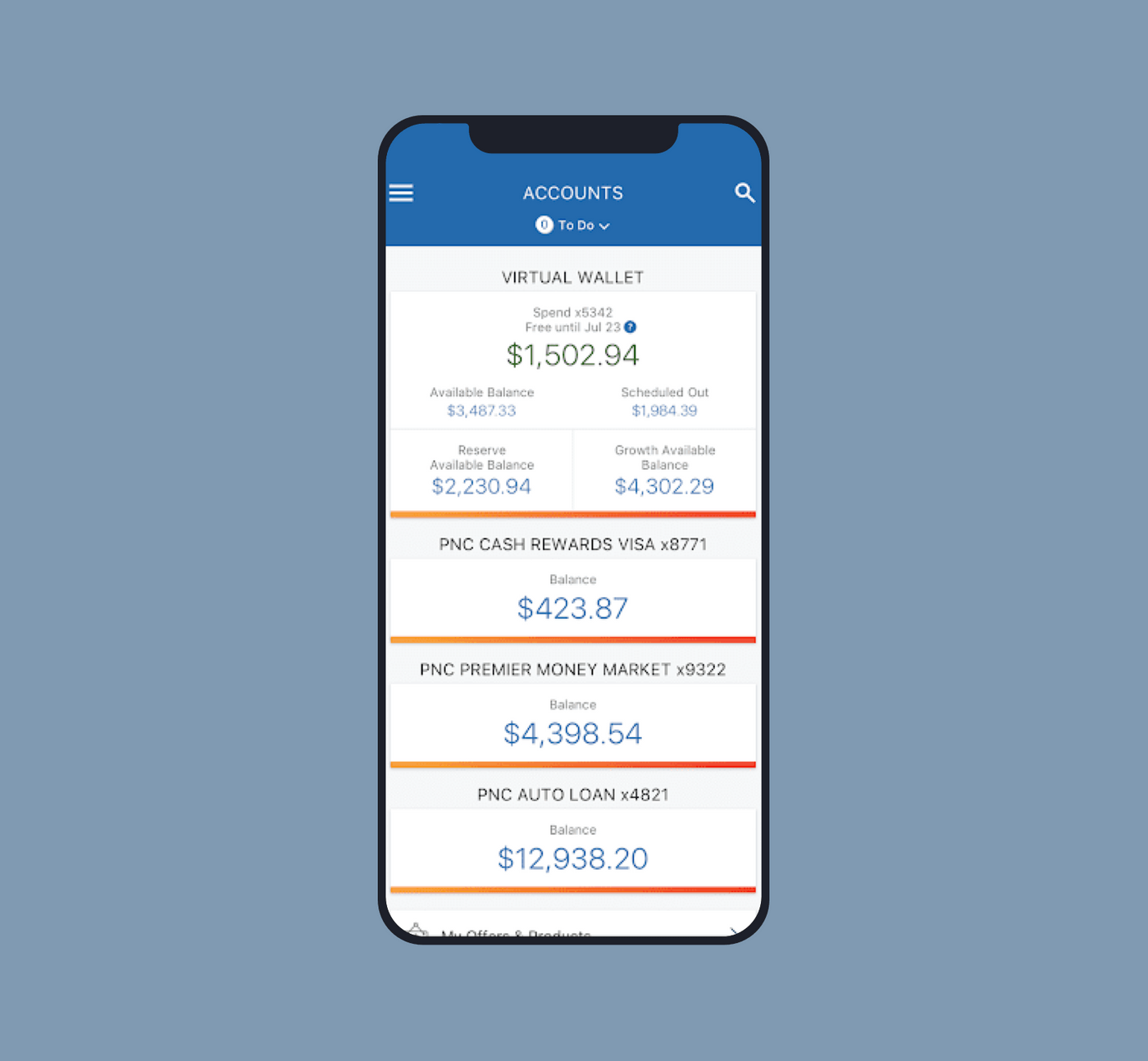

Account Management

This feature is the basics of all banking apps and includes the following operations:

- Balance check. The information about balance should be the same on all devices and should be instantly updated in the app and on the website.

- Cards and bank accounts management. This category includes ordering cards, closing an account, attaching new cards to an account, and so on.

- Recent transactions. One of the most important features that let users track their expenses.

- Deposit check. Opening a deposit, displaying its conditions and interest on the deposit.

PNC mobile app account management screen.

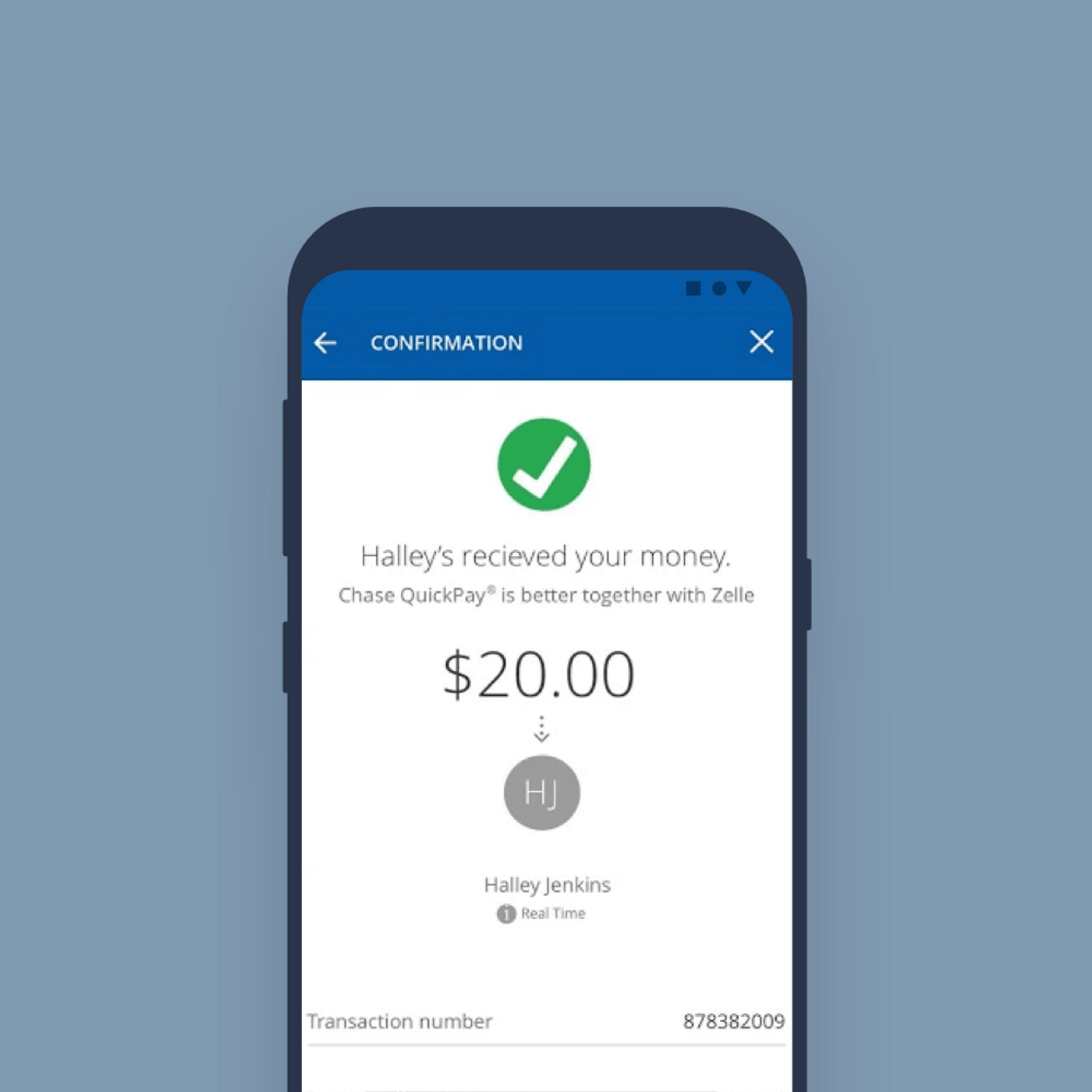

Quick Transactions

Fast and easy transactions between accounts are something that users appreciate. No banking app can do without this feature. It's a system implemented on the server side of the bank where transactions are processed. The app simply displays the result of the transaction.

Chase quick transactions.

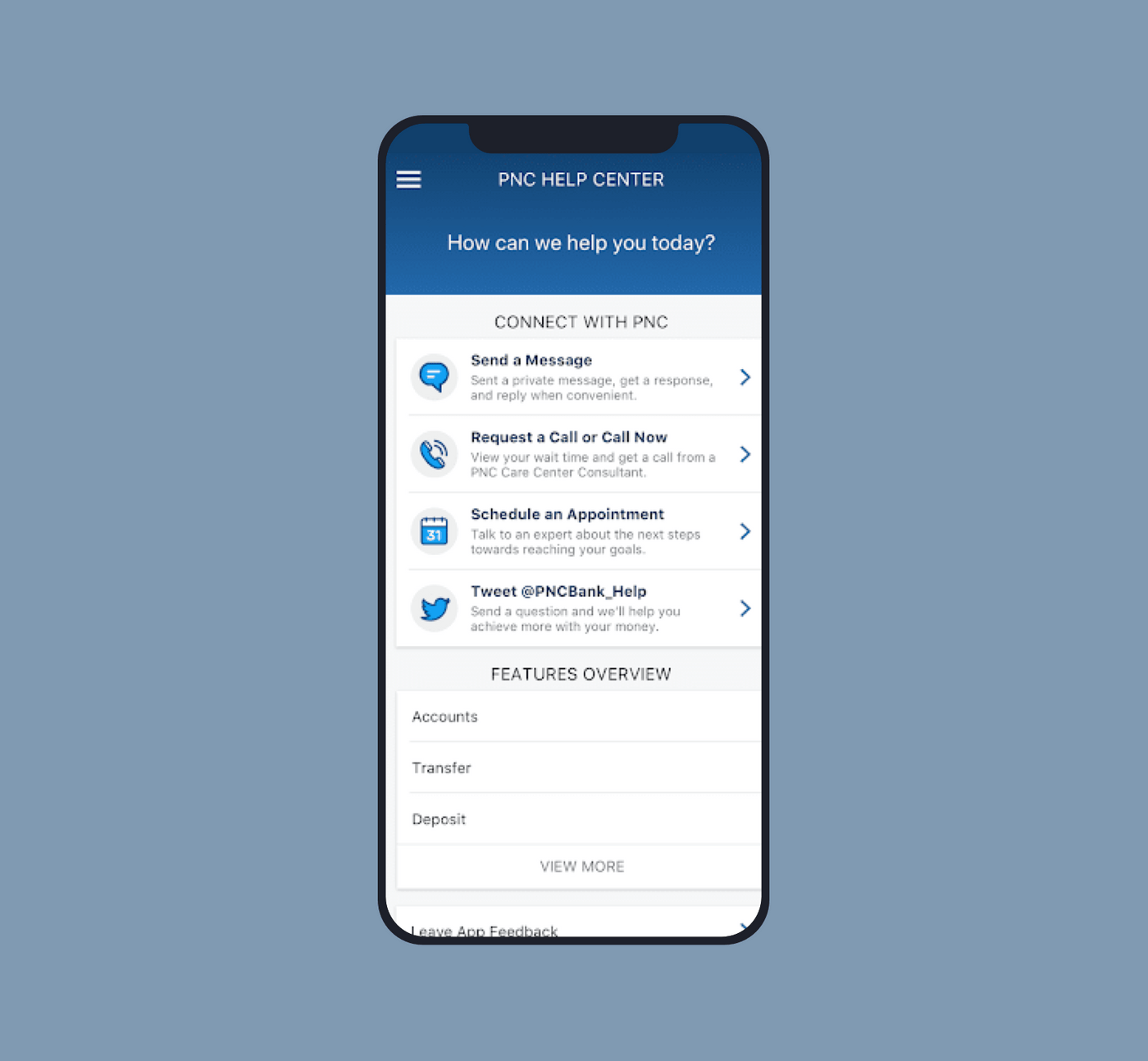

Customer Service Access

You can't build a banking app and leave users on their own. They can encounter problems or can have questions while using the banking app. Therefore, it's necessary to provide users with 24/7 access to support. You can choose between two paths how you can pull this off.

PNC mobile app help center.

The easiest way is to connect the user to the support group via chat inside the app. The hardest one will be to create a chatbot that will take over the responsibilities of support service. However, creating a bot is a rather complicated process from a tech point of view. Besides, you must know what questions users may ask and compose correct answers. However, a chatbot can quickly pay off, as it can save you money on customer support with its implementation.

Secure Authentication

Access to the app should be simple yet secure. Let users enter the app in different ways. By far, the most popular ways to sign in are:

- Using a password

- Using a fingerprint

Fingerprint login has already become the standard for banking apps due to its convenience and security. This method can be used to secure every transaction, change of password, and other actions within the app.

Capital One secure authentication interface.

Push Notifications

Push notifications are an important feature that connects banks with users. Banking apps can use three types of push notifications:

- Transactional notifications. Crediting money to accounts, confirming transactions and other related operations.

- Advertising notifications. Promotional offers, discounts, and so on.

- App-based. Request to send documents, change password, and so on.

Discover mobile app push notifications.

ATMs and Branches Map

This feature is greatly improving the overall user experience and showing you care about your customers. In addition to a simple location, you can add information about the opening hours of branches and weekends. This feature can work using Google Maps on iOS and Android.

Heritage Bank ATM map.

QR Code Payments

This feature is another step to a multifunctional banking app. Let users pay for purchases, buy tickets, and pay anywhere using QR codes.

Nice-to-Have Features

Nice-to-have features mean that you can create a banking app without them, but they'd take the user experience to the next level. Still, they can be developed right after the key features for quick time to market.

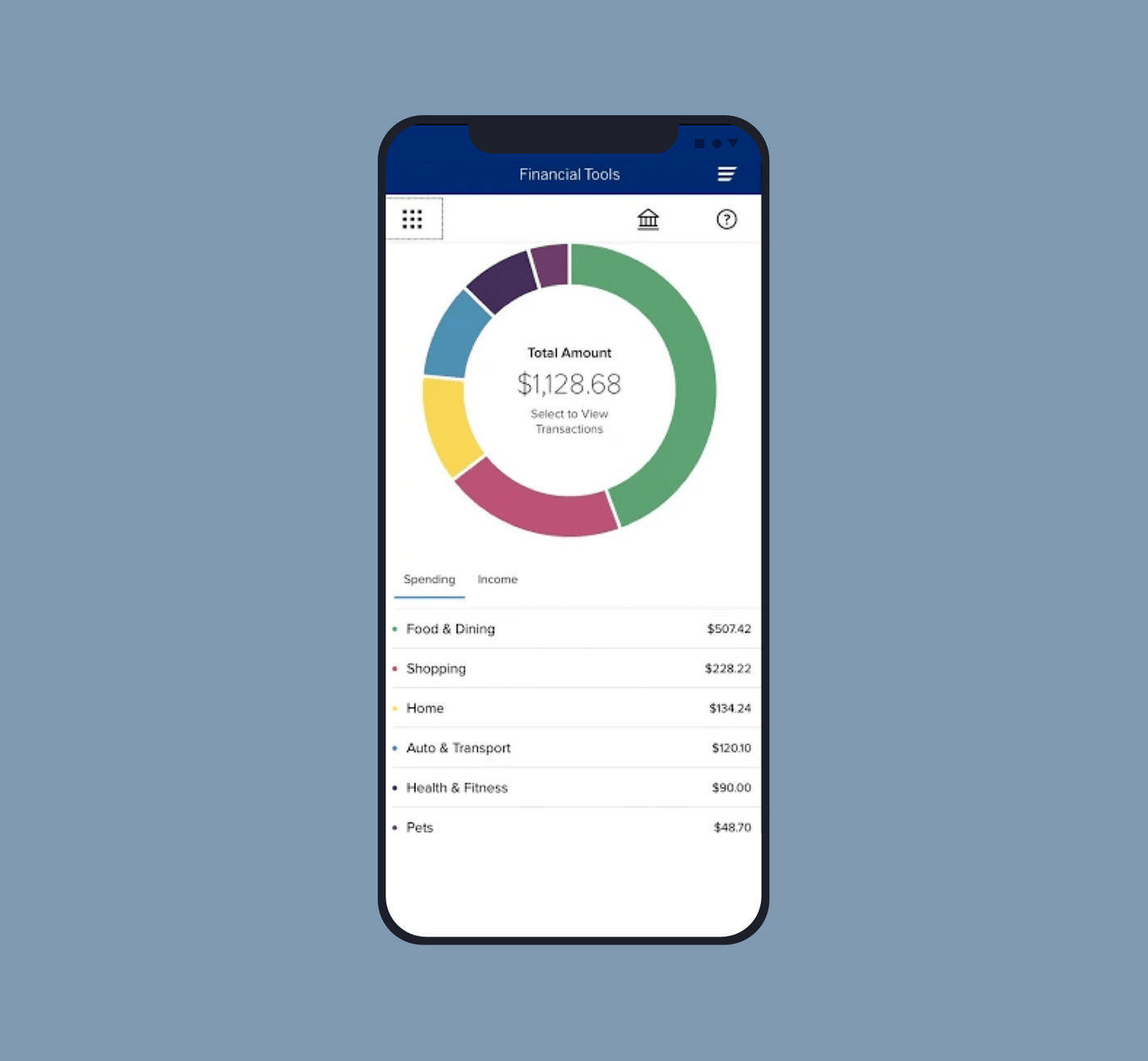

Spending Tracker

Users often worry about how much they spend and where the money goes. Banks often allow users to track their spendings within the app.

BBVA spending tracker.

Use graphics and smooth animations to make the information clear. Think about the categories people spend their money on. This can be food, transportation, entertainment, health, and many others. By including them in the tracker, you'll bring more flexibility to expense tracking.

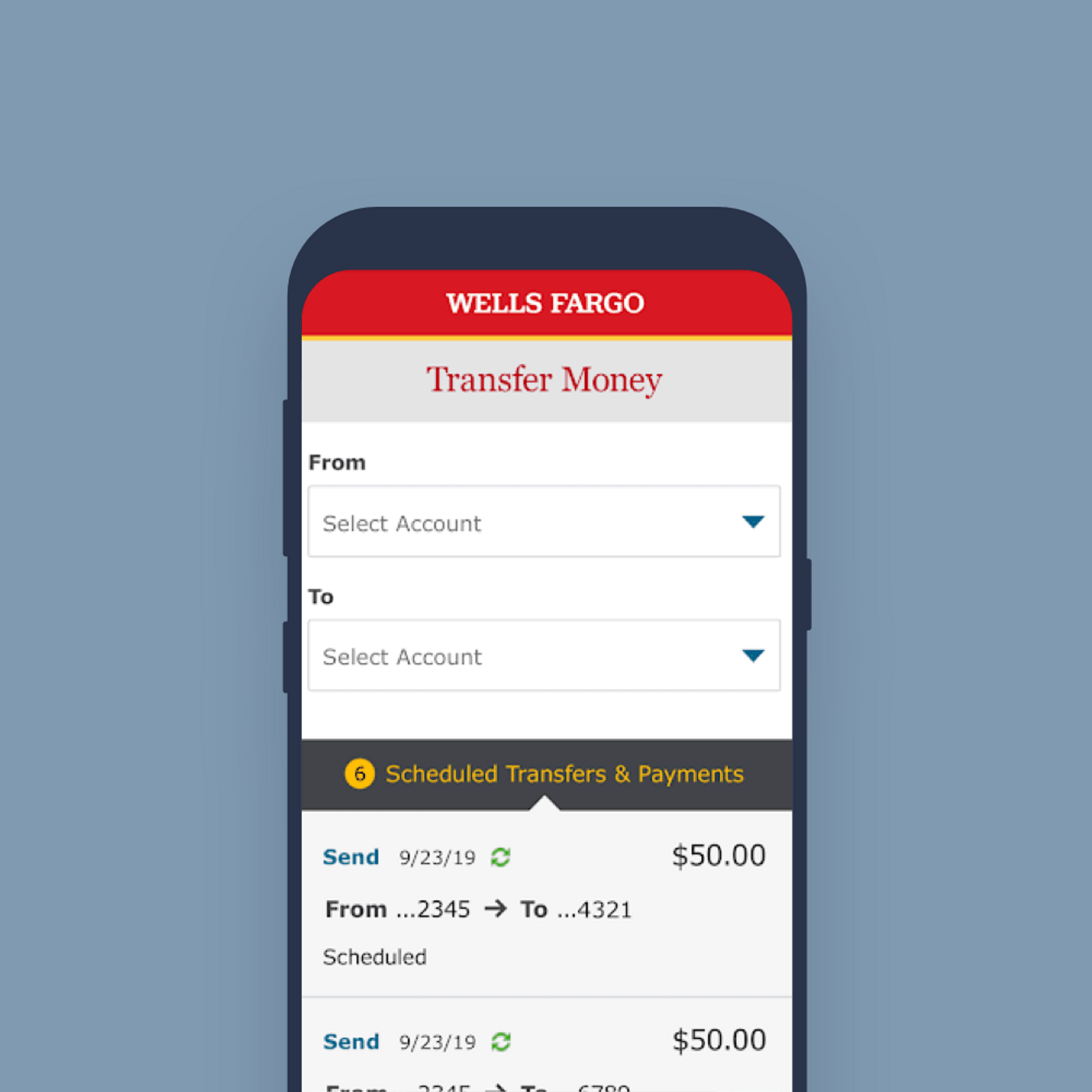

Repetitive Payments

With this feature, users can speed up their routine payments. Customers often have several payments they make each month or a couple of months. So it'd be a good idea to let them put those payments on autopilot.

Wells Fargo repetitive payments.

The repetitive payments can work in two ways:

- Auto charges

- Reminders to make a payment

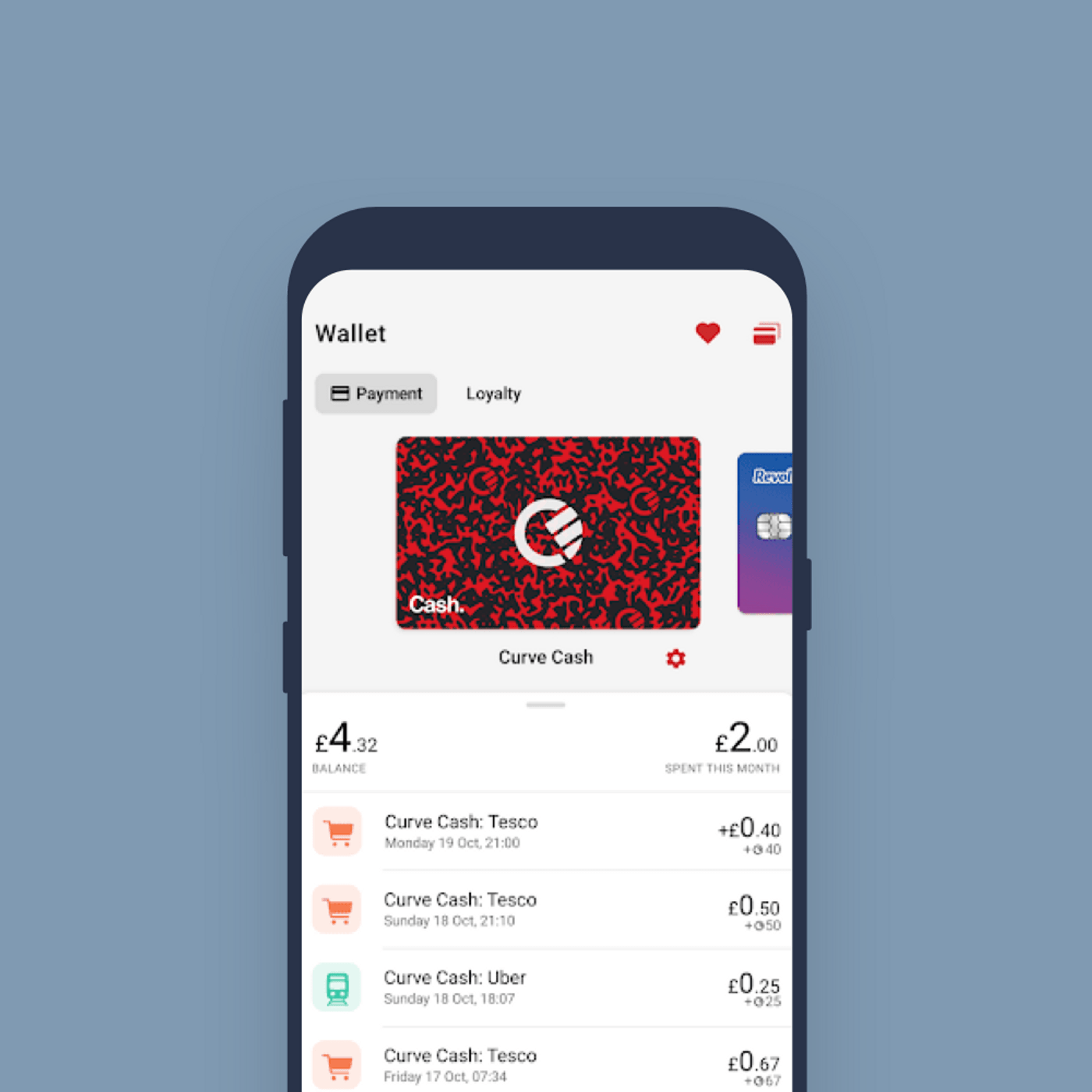

Cashback

The cashback is a great way to stand out from other banks and reward customers for choosing your service. Some banks even let users pick the categories they'll be receiving the cashback for. It can be transactions related to entertainment, travel, cafes and restaurants, and other categories.

Curve cashback system.

Bill Splitting

A fairly simple feature in its essence, but this is what many users expect from banking apps. This feature solves the age-old problem of splitting the bill in a cafe or restaurant. Users can easily share the bill between everyone sitting at the table and quickly pay for it.

How to Create a Banking App Step-By-Step

Now that you know what features should be added to the banking app, it's time to take a look at how to build it. We'll walk you through the scenario of creating a banking app step-by-step.

Step #1. Create and Test a Prototype

You may be asking: "Why do you need a prototype if you can go straight to development?" A banking app is a complex mechanism with many features that makes it challenging to develop from scratch.

A prototype is a great way to test your idea with your target audience. Identify what user problems you want to solve and implement the features solving them to achieve your goals.

The development of a prototype is several times cheaper than the creation of a full-fledged banking app. Besides, the prototype is flexible in terms of modification. It's much easier to fix a bug or tweak a feature during prototyping.

Listen to the wishes of your audience, accept criticism. This valuable information will help improve the app in the future.

Step #2. Take Care of the App's Security

When you build a banking app, security is what really matters. So developers must think of it from the early development stages.

Here are some basic tech methods to build a secure app:

- Data encryption algorithms (SSL and 256-bit encryption). These algorithms encrypt the app's data and can only be decrypted by the user with the correct encryption key.

- Source code obfuscation. It stands for bringing the source code to a form that preserves its functionality but makes it difficult to analyze and modify during decompilation.

- Repackaging protection. App repackaging means that a hacker obtains a copy of the app, unpacks it, adds malicious functionality, and then repacks it.

At a more superficial level, you should also protect user data. The main methods of protection are:

- Verification of transactions through generated codes

- Two-factor authentication

- Reminders for users to change their password regularly

- Fingerprints and FaceID authentication

Step #3. Find the Team

Building a mobile banking solution is quite a laborious and time-consuming task. What's more, it requires a lot of experience from the team working on it.

The best option is to turn to software development companies. Vendors that have experience in the FinTech industry will be able to bring your ideas to life. Almost all software development agencies sign an NDA so your intellectual property is protected.

Software development vendors can be found on specialized platforms that collect information and feedback about IT companies from around the world. The most famous aggregator are:

- Clutch

- GoodFirms

- IT Firms

Step #4. Release the App and Gather Feedback

The release of a banking app in the App Store and Google Play Market is quite a tricky process. Both stores have rules and regulations that must be followed. For example, in the App Store, there are App Store Review Guidelines. If the app doesn't meet them, the app will be rejected until requirements are met.

After the release, you'll get your first feedback from users with comments about bugs and improvement suggestions. That's valuable information that can help you in product development.

Main Challenges in Mobile Banking

When developing a mobile banking application, product owners and developers run into challenges typical for the FinTech industry.

Tech Challenges

The development of banking apps is full of technical nuances that developers must take into account.

Auto-inputs

Developers need to disable auto-inputs in all UI fields where any kind of information can be entered. This is important to protect the app from third-party malware extracting data from the app.

Blur view

The blur view is added when users switch between apps. This feature is implemented for additional security to protect sensitive data from being seen by strangers. The last app screen won't be visible due to the blur effect applied to it.

In-memory data storage type

Banking apps use a specific approach to storing data, called in-memory type. Programmers implement this type to ensure that all downloaded or received data is cleared when the app is deleted. When using in-memory databases, the user data could not be "physically" retrieved from the device. Even if the device is hacked, the data cannot be obtained.

Regulations

FinTech companies and banking apps are subject to regulatory requirements like any other technology solution.

The main regulations for banking apps are:

- GDPR Compliance. This regulation concerns any personal data and is applied to all organizations that provide goods or services for EU citizens.

- PCI DSS Compliance. - It's applied to any merchant or service provider that handles, processes, stores, or transmits credit card data.

- SEPA Compliance. It covers any organization of the European Union and other European countries using the euro for transactions.

- PSD2 Compliance. It applies to any payment that happens in the European Economic Area.

Wrapping Up

Banking apps are complex systems and they're pretty hard to build. It's vital to comply with high security standards, regulations and operate with an advanced tech stack to create a banking app for business.

At Cleveroad, we're paying attention to the overall project requirements and operating only up-to-date technologies in developing personalized software for business. We're creating cutting-edge FinTech solutions using Kotlin and Swift, bounding these programming languages with powerful server sides built with Node.js and .NET and adding reliable third-party solutions like Amazon S3, Amazon EC2 and socket.io.

Need a reliable FinTech solution?

Drop us a line to get your free tech consultations.

Frequently Asked Questions

We'll walk you through the scenario of creating a banking app step-by-step.

- Step #1. Create and test a banking app prototype

- Step #2. TakecCare of the app's security

- Step #3. Find the development team

- Step #4. Release the app and gather feedback

Mobile banking is a service provided by a bank that allows users to conduct financial transactions using mobile devices.

There are several must-have features for banking app:

- Account management

- Quick transactions

- Customer service access

- Secure authentication

- Push notifications

- ATMs and branches map

- QR code payments

- Over the top security

- Comprehensive set of features

- Pleasant and simple design

- Long-time support

Rate this article!

625 ratings, average: 4.63 out of 5

Give us your impressions about this article

Give us your impressions about this article

How To Create A Banking App

Source: https://www.cleveroad.com/blog/how-to-create-a-banking-app

Posted by: taylorcultin.blogspot.com

0 Response to "How To Create A Banking App"

Post a Comment